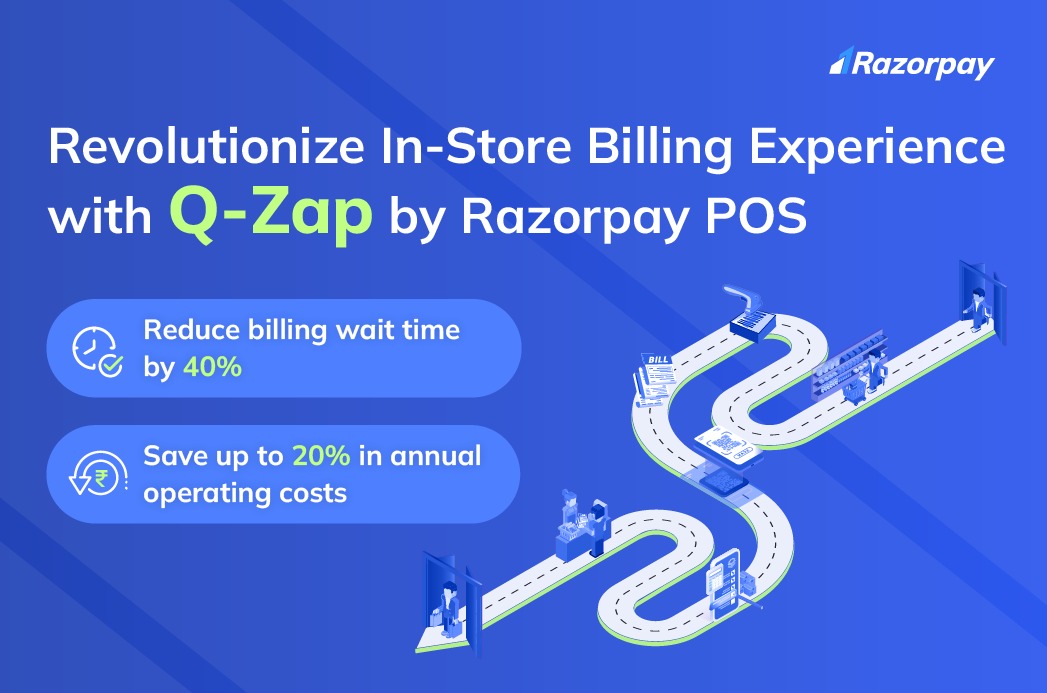

Fintech unicorn Razorpay's offline payments arm RazorPay POS has launched a new payment solution 'Q-Zap' for offline retailers to reduce billing time.

The startup claimed that the suite can help merchants reduce in-store billing time by 40% and save up to 20% in annual operating costs.

The Q-Zap suite encompasses handheld devices, which store staff can use to accept payment from consumers anyplace within the store, and kiosks and vending machines, which allow self-checkout.

On the software front, Q-Zap provides customised enterprise resource planning (ERP) integrations that allows store personnel to access customer info, product pricing, and update inventory in real-time.

"Q-Zap, our queue-busting solution, aims to not only eliminate tedious checkout lines for customers but also to free up in-store staff's time so they can be available to customers and provide them assistance, which could include answering questions or facilitating customer checkout," Razorpay's COO Rahul Kothari said in a statement.

The company's bid to bolster its point-of- sale (POS) offerings comes at a time when the space is brimming with new innovations. For instance, its competitor BharatPe launched a new 'all-in-one' payment device 'BharatPe One', which integrates point-of- sale (POS), QR code scanner, and speaker, earlier this year.

While fintech players are experimenting with their PoS devices, deployment of new Pos was muted in the last fiscal year. The deployment of new PoS terminals rose by a mere 14% in the financial year 2023-24 (FY24) as against growth of 28% and 29% witnessed in the preceding two years. As per RBI data, the number of PoS terminals stood at 8.9 Mn at the end of March 2024.

--Advertisement--

Share

Share